How Do I Go Back to College?

Are you thinking of returning to college? It can be both an intimidating and exciting prospect. The good news is that admission counselors are in place to help throughout the process, to answer early-stage questions, guide you through applying and prepare you for enrollment.

Whether you’re still deciding or if you’re ready to apply, it's important to know that you’re not alone in your journey.

How Do I Start the Process of Going Back to College?

As you prepare to go back to school, consider your motivations for pursuing an education, how you can fit classes into your life and begin researching schools you might want to attend.

What Are My Motivations for Returning to School?

Figuring out your motivations can help you decide what to major in and what school to attend.

Many people go back to school because they want to change careers or advance in their current field, said James Patterson, an admission counselor at Southern New Hampshire University (SNHU). You might have similar reasons, or maybe you simply enjoy learning and want to expand your knowledge on a certain topic.

Patterson said he has conversations with potential students about why they’re interested in the major they’re considering and what they want to do with their degree.

“Everybody kind of has their own reason,” he said. He noted that knowing your reason for returning to school can play a big role in your educational journey. For example, if you enjoy telling stories or want to work as a writer or editor, you might pursue a Bachelor of Arts (BA) in English or a BA in Creative Writing. Maybe it's been a many-years-long goal. Whatever the reason, it may prove motivational as you continue toward that goal.

How Can I Fit School into My Life?

After you have figured out your “why,” the next step is to take a look at your current situation to assess how college might fit into it.

Whether you’re working or taking care of your family full-time — or even a mix of both — and have other responsibilities to regularly attend to, it might be difficult to see how you can fit college into your schedule. That doesn’t mean it’s impossible, though. Taking classes part-time or attending online can help you ensure you’re not neglecting your other commitments.

It’s also important to consider your financial situation. Seeing if you qualify for financial aid by applying for the Free Application for Federal Student Aid (FAFSA) may help you fund your education.

“FAFSA can come in the form of loans or even grants, as an example,” said Maryann Serrilla, an admission counselor at SNHU.

If you want to learn more about how financial aid works, Serrilla recommended reaching out to the Student Financial Services office at the schools you consider. Their counselors can help you with the process and answer questions you might have.

How Do I Choose a College?

After you’ve examined your current situation, you can explore which colleges offer options that work best for you. You might research schools based on:

- Accreditation - Researching what accreditations a college has can help you narrow your search. An accredited school has undergone review to ensure its programs meet certain quality standards. Patterson said he goes over program accreditations with those interested in attending SNHU.

- Cost - Education is an investment, and it’s important to find a college that offers a financial aid package that works for you.

- Location - If you aren’t interested in attending online classes, look for a school near you. Be sure to consider travel times to make sure you can fit the commute into your schedule along with your classes.

- Programs - Knowing why exactly you want to go back to college can help you to choose a major or a field you want to pursue. This can help you choose a school that has a degree relevant to what you want to study.

- Student life - Whether you’re interested in learning on-campus or online, you might research the student life at an institution. Many schools that offer online programs also have clubs and organizations that meet virtually, so you can still socialize with other students without being on a physical campus.

Admission counselors can usually answer any questions you have about these factors. "Providing that support is one of the core focuses of being an admission counselor here (at SNHU)," said Serrilla.

Find Your Program

What Does the Admissions Process Look Like?

When you’ve decided on a school you’d like to attend, the next step is the admissions process. Before you submit an application, make sure to check deadlines. Serrilla recommended applying as early as possible.

Some colleges may require items such as transcripts, letters of recommendation or test scores. It can be helpful to have all the materials you need available before you reach out, said Serrilla.

If you’re unsure what you might need or have any questions about the process, schools like SNHU have a team of admission counselors who can guide you through the process.

How Do I Balance School With the Rest of My Life?

Once you’ve received an acceptance letter, it’s important to make a plan to fit your education in amongst your other responsibilities. This is a great time to consider things such as time management and work-life balance.

“Going back to school can be a daunting task,” said Dylan Talbot, an admission counselor at SNHU. “Students need to get familiar with what to expect and how starting courses works.”

An admission counselor may be able to point you in the direction of relevant resources that can help you brush up on study skills, learn required software or connect with other students.

Time management tools can help you stay on top of academic deadlines as well as events in your personal life.

Using your phone’s calendar to keep track of assignments or due dates can be helpful, said Serrilla. Some other options you might consider include Google Calendar, Notion or a physical planner. As a current SNHU student herself, Serrilla noted that it’s important to find what schedule works best for you.

While your education is important, so is taking care of yourself and ensuring your personal needs are met.

“Be intentional and pro-active,” said Talbot. “You have to set aside time for school and factor in time for yourself as well.”

At SNHU, you can access your classes two weeks before the term starts. "It's a great idea to log in (and) get used to the platform," said Patterson. Getting a head start on your assignments can be helpful just in case something comes up in your personal life.

If you begin to feel overwhelmed after you start classes, that’s totally normal. You can always reach out to your instructor or academic advisor to let them know how you’re feeling, and they might be able to provide tips or resources to help you.

Is Going Back to School Worth It?

It’s never too late to go back to college. No matter your age or stage in life, you can still benefit from returning to college if it’s something you want to do.

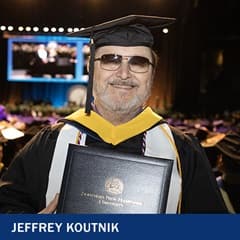

Jeffrey Koutnik '24 was interested in attending college after he graduated high school in 1977, but he wasn’t sure it was an option.

“I was a D student in high school,” he said. “My counselor said there was no way I was going to be able to make it to college with my grades.”

Koutnik decided to pursue a different route and joined the U.S. Air Force, where he served for 20 years.

Later on in life, Koutnik was diagnosed with attention deficit disorder (ADD). He began taking medication that helped him to concentrate better.

“That’s when I decided to pursue getting a college degree,” he said.

At first, he was just curious to see if college would work for him. And it did. Koutnik graduated from SNHU with honors and received his Bachelor of Science (BS) in Business Administration with a concentration in Project Management, with his wife and his daughter joining him at Commencement.

Koutnik is not the only person who found success in going back to college years later.

When Demetria Garduno '24 finished high school, she attended community college on and off for a few years. After getting married and having a child, she decided to focus on being a mom for a while, which meant putting her education on hold.

In 2021, Garduno realized she was ready to pursue a bachelor’s degree and earn a BS in Healthcare Administration with a concentration in Patient Safety and Quality.

“I decided that I wanted to put time and effort and focus into myself,” she said.

Garduno’s time at SNHU helped her realize she often puts others’ needs above her own, but she is learning to prioritize herself so that she can better support her family.

“I’m important, and I matter,” she said.

Garduno said she chose SNHU for the community and that the shorter terms were a great fit for her with her son. She also said the admission counselors were encouraging about going back to college after a gap, and she was able to transfer credits.

“No matter how long it takes (to get a degree), you can still earn it at any time,” she said. “Time is not a barrier.”

A degree can change your life. Choose your program from 200+ SNHU degrees that can take you where you want to go.

From the time she was a child, Ashleigh Worley '22 found inspiration between the pages of books. Before long, she fell in love with telling stories herself. That love followed her into adulthood, leading her to earn a Bachelor of Arts in English Language and Literature from Southern New Hampshire University (SNHU). Today, Worley is a writer at SNHU, where she's pursuing a Master of Fine Arts in Creative Writing. When she's not writing, she's usually enjoying time with her dad and her abundance of cats. Connect with her on LinkedIn.

Explore more content like this article

Is Getting a Second Bachelor’s Degree Worth It?

Picture an Online Degree at Your Own Pace

How to Make Connections in College

About Southern New Hampshire University

SNHU is a nonprofit, accredited university with a mission to make high-quality education more accessible and affordable for everyone.

Founded in 1932, and online since 1995, we’ve helped countless students reach their goals with flexible, career-focused programs. Our 300-acre campus in Manchester, NH is home to over 3,000 students, and we serve over 135,000 students online. Visit our about SNHU page to learn more about our mission, accreditations, leadership team, national recognitions and awards.